On December 8th, the Eye & Ear Foundation hosted a special webinar, “A Vision for the Future: Hear About Planned Giving.” While the regular Sight + Sound Bite webinar series covers the work that EEF supports, many people have questions about planned giving. As a Foundation, EEF can work with people on planned giving, done in collaboration with colleagues at the University of Pittsburgh and UPMC. The webinar was led by Lawton Snyder, EEF CEO, and Cynthia Caldwell, JD, Assistant Vice Chancellor, Development and Planned Giving, Health Sciences, University of Pittsburgh and UPMC.

“EEF supports research to advance care for vision, hearing, balance, voice, and cancers in the head and neck at the two renowned Departments of Ophthalmology and Otolaryngology-Head & Neck Surgery,” Snyder said. “The funds we provide from EEF to support research are only made possible because of philanthropic support.”

Caldwell focuses her time on leading four fundraising teams, covering Health Sciences schools, residents, fellows, grateful patients, and planned giving. She also works with a portfolio of donors to raise donations for funds across the health sciences as well as helping inform strategy and high-level initiatives for multiple areas within the health sciences.

“A planned gift is something that is beyond our time – making a gift while you are still around,” Snyder said.

H.R. 1 – “The One Big, Beautiful Bill”

This bill was signed into law on July 4, 2025, and covers many different areas, from taxes to Medicaid. For the webinar’s purposes, the focus will be what affects charitable donations and educational institutions.

Changes Affecting Charitable Donations

- Permanent deduction for non-itemizers

- In 2026, single taxpayers who don’t itemize can deduct up to $1,000 in charitable contributions ($2K for joint)

- DAF (Donor-Advised Fund) donations are excluded from this universal deduction – only straight cash to charity

- Increased standard deduction and inflation indexing from 2017 Tax Cuts and Job Act are now permanent – $31,500 for MFJ and $15,750 for single

- A few other changes for itemizers, like a 0.5% floor (0.5% of AGI without charitable donations) on the income tax charitable deduction and a cap of 35% of the tax reduction on charitable donations for the highest income taxpayers – 37% bracket

- Federal estate tax exemption change – 2026 – $15M/person – permanent, inflation indexing starts in 2027

Changes Affecting Educational Institutions

- Endowments – tax imposed on colleges and universities with the following investment assets/student:

- 1.4% tax if $500-750K/student

- Increases tax from 1.4% to 4% if $750K-2M/student

- Increases tax from 4%-8% if more than $2M/student

- Schools with fewer than 3,000 students are exempt

- Graduate PLUS loan program will be phased out for new borrowers as of July 1, 2026

- Deferments – unemployment and economic hardship deferments eliminated for loans taken after July 1, 2027

- Lifetime caps for:

- Unsubsidized loans – graduate students – $100,000; annual = $20,500

- Professional degrees, e.g. law, medical – $200,000; annual = $50,000

All student borrowers – $257,000

CGA General Overview: What, Who, Why

A Charitable Gift Annuity (CGA) is a planned giving arrangement where a donor makes a gift to a charity and in return receives fixed lifetime income payments. It benefits the donor and/or annuitant (could be the same person). This could be the donor, donor and spouse, or annuitant that is a friend or other family member. The annuitant must be a person, as the IRS prohibits the annuitants being a trust or corporation. Each CGA can only have two annuitants max. A CGA also benefits a university fund of the donor’s choosing.

Benefits to the donor include:

- Steady lifetime income

- Immediate tax deduction (with most funding types)

- Can reduce capital gains tax

- Remainder goes to Pitt to fund an area of your choosing (not UPMC)

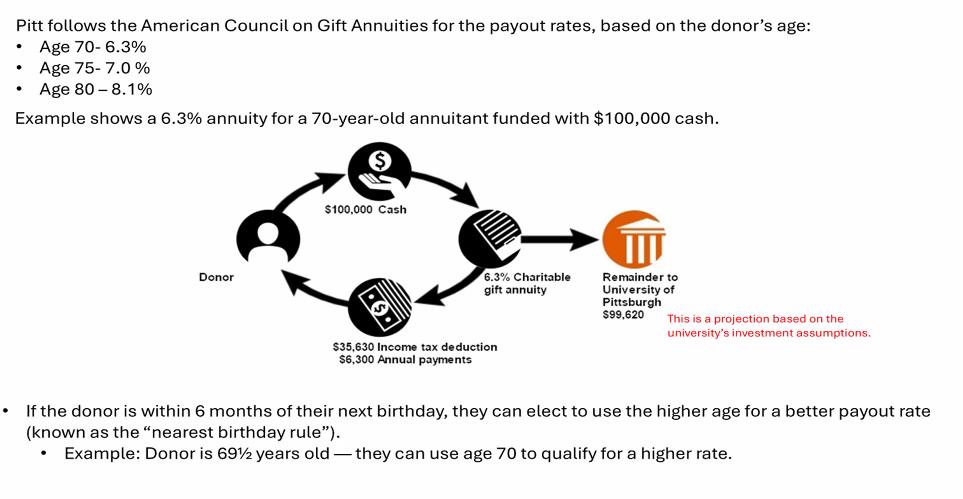

Pitt follows the American Council on Gift Annuities for the payout rates, based on the donor’s age:

- Age 70 6.3%

- Age 75 7.0%

- Age 80 8.1%

If the donor is within six months of their next birthday, they can elect to use the higher age for a better payout rate (known as the “nearest birthday rule”).

Step by Step

- Gift Officer shares illustration with donor; if approved, the officer works with general counsel to have a contract drafted

- After review of illustration and contract, contract is executed

- Fixed payments for life (full faith and credit obligation of University)

- Pitt, through BNY Mellon, invests the funds within the CGA reserve pool

- Annuitant(s) receive payments monthly, quarterly, biannually, or annually. After the annuitant’s death, remainder goes to the fund of the donor’s choosing

CGAs funded with IRA QCDs

- Starting at age 70 ½ or older, donors can now make a one-time IRA QCD of up to $54,000 (indexed for 2025) to fund a life-income gift, such as a charitable gift annuity (CGA) without being taxed on the distribution

- Exciting, right?!?! BUT there are limits…

- The transfer is one-time only, up to $54,000 in a single year. So, a donor can transfer an amount less than $54,000 in a year from their IRA, then create more in the same year. But no additional transfers are available in future years even if the total gift is less than $54,000.

- All CGA payments are fully taxable at the recipient’s ordinary income tax rate. Only the IRA owner and/or his/her spouse may receive payments from the CGA.

- A CGA funded by the new QCD must have a payout rate of at least 5%. It could be an issue if rates drop or if a spouse is much younger than the IRA owner for a joint annuity.

- CGAs cannot be deferred, only immediate.

- The donor does not receive a charitable deduction.

Donor Advised Funds

Definition, according to the IRS: Generally, a donor advised fund is a separately identified fund or account that is maintained and operated by a section 501(c)(3) organization, which is called a sponsoring organization. Each account is composed of contributions made by individual donors. Once the donor makes the contribution, the organization has legal control over it. However, the donor, or the donor’s representative, retains advisory privileges with respect to the distribution of funds and the investment of assets in the account.

- Cannot be used to fund CGAs

- Can usually add a remainder designation as part of your estate planning, as some accounts may have balances upon your passing

- DAFs can be advantageous for donors who want to increase their giving to meet a higher standard deduction for income taxes (i.e. bunching). NB – cannot be counted as part of universal deduction.

- Pitt does not have its own DAF

Ask your financial advisor for some DAFs they could recommend. Pittsburgh Foundation is a popular one here.

Bequests

- Most common vehicle in planned giving

- Definition, according to Merriam-Webster

- The act of giving or leaving something by will

- Three types of bequests:

- Specific – a set amount or a specific asset is given to charity. “I give $100K to Pitt.”

- Residuary – all or a portion of the estate goes to charity after specific amounts are distributed to other beneficiaries. “I give 25% of my estate to Pitt.”

- Contingent – assets are distributed to charity only if primary beneficiaries do not survive the donor. “If all of my children predecease me, I give my estate to Pitt.”

“Don’t hesitate to reach out to me if you need to,” Caldwell said. “I’m happy to discuss any of these options.” She can be reached at cec82@pitt.edu.

Other Things to Know

Snyder then covered some things he felt were important for people to know, because a 501(c)(3) is a nonprofit. EEF can take advantage of a few things because it’s not as large as Pitt. If a donor wants to do a gift annuity, EEF works with Pitt. It can be established through Pitt, and the ultimate benefactor can be one of the Departments that EEF works with. You can even be specific about the type of research you want to support.

Most people doing planned gifts through their estate are looking at how they can allocate assets. Sometimes EEF will send people interested in making a planned gift a letter of testamentary intent. They can sign it, put the percentage they think they will be allocating through a fund, or put an actual number. This way EEF knows the donor’s exact intent when those funds become realized.

Benefits

The biggest benefit to signing this letter is to ensure that your intent is known, recognized, and understood by the actual charity you are working with, Caldwell said. If you are really passionate about a type of research yet it is not clearly conveyed, it might go into a general research bucket fund. It is important to make sure the language is clear so future generations can benefit.

Caldwell pointed out that with several retirement plan accounts, the beneficiary paperwork is very limited with the number of characters you can put down. “Anyone would be happy to work with you to write down a fuller designation, because sometimes a charity name won’t fit in 40 characters,” she said. You could say a very shorthand version of the charity name and then work with the charity to further document how you want the funds used.

Stewardship is another benefit. If you work with the charity to advise them of your intent to give later on, they will be able to update you on your relevant interests. You may be invited to several different nice events, basically stewarding you now while everyone can enjoy it as opposed to the charity receiving paperwork in the mail decades in the future advising of your lovely gift.

Snyder said sometimes he can sense some hesitancy in signing a letter of testamentary intent. You may be wondering, “What if I can’t keep this promise?” There is so much unknown ahead of us. Caldwell said this is the first thing they try to reassure people about – the letter is not legally binding. “It is just to help advise us of your intent and make sure that we’re clear on it, so when the time comes, we can honor it,” she explained. The number associated with it is truly a guesstimate; you will not be held to it.

Assets

Snyder said people also wonder about assets. Maybe they have assets in different types of stocks and bonds, mutual funds, etc., but also have 401K assets, and are trying to think about supporting their family, favorite charity, etc. Caldwell said the biggest piece of making sure to maximize every one of your hard-earned dollars with retirement plan assets is that they would be taxable when passed on to other individuals to inherit. “You don’t want to burden your kids or others with that piece,” she cautioned.

If you were to convey the stock, then upon your passing, it would be a step-up in basis for whoever inherits it. They would not have to realize capital gains if they were to sell it immediately.

Both assets can be conveyed directly to 501(c)(3) charities without the tax implications. “It’s about what would be best for you in your financial holistic approach to your portfolio,” Caldwell said, “whether it’s getting kind of down into the nitty gritty of rebalancing your portfolio and perhaps offloading some stocks or funds that you don’t need right now or don’t make sense, or realizing you have some assets in your retirement account that you can pass along.”

Snyder pointed out that this makes sense, because you do not pay taxes on what you put into the 401K during your lifetime, so it has to come out afterwards. A lot of people do not realize that the burden will then be on your kids or whoever inherits it. By giving to a 501(c)(3), this can be avoided.

Snyder shared that he had a nice surprise upon arriving at the office that morning; one of EEF’s donors is establishing a charitable remainder unitrust, a very generous thing to do. He asked Caldwell to explain what this meant. She said there are two kinds of charitable trusts: a charitable lead trust, and a charitable remainder trust. “Quick difference: Whatever is closest to the word charity, that’s when the charity receives it,” she added.

With a charitable remainder trust, it is an irrevocable trust. You donate assets to it and then receive an income stream for either a set term or for someone’s life. A charitable lead trust is the opposite; the charity would receive payments during the lifetime or for a term – a powerful way to sometimes avoid immediate capital gains tax. Remaining assets can be given to the charity, which will grow within the corpus of the trust. This is a great way to facilitate tax planning, tax deductions, and often seen as a way of promoting philanthropy throughout the generations, because it is often a family decision to come together and create a trust. “With a trust being a whole other entity, this is not something that is done lightly,” Caldwell said. “I have to counsel as an attorney by training to lean on your independent advisors before going down that path.”

Snyder shared that the charitable remainder trust was created by a former EEF Board member who passed away this year. It was in his late wife’s name, so it was held until both of them had passed. Now it will be going to the charities, and EEF is receiving a portion of that. A vehicle like this means you can name more than one charity. “It warms my heart, because this was a great guy,” Snyder said. “It made me feel really good that he thought of EEF. I know he cared a lot about the work that we’re doing.”

Reasons to Make a Planned Gift

Someone asked what are some of the main or personal reasons that people choose to make a planned gift. “One of the big motivators that I have about being in my current position and really being in fundraising in general is I get to be almost like a problem solver and help people figure out what’s best for them,” Caldwell said. “What best fits their passion, family preference, financial goals. While we all want to give to a certain charity based on their mission and vision, sometimes the tax man is there ever-present in the back of our heads as we’re trying to make these decisions.”

People might want to keep cash handy and therefore consider a residuary gift in a bequest, so having enough cash is not a current concern. Planned giving also does not have to involve a lawyer. You can just print a beneficiary designation form from a service provider or retirement account.

Caldwell said it is great to work with individuals because she gets to know them on an individual basis, and then they honor and trust her enough to talk about more of those financial details and goals. “That’s why I truly love my position,” she said. “It’s an honor. We’re very corny in planned giving. We’re almost elevated to the level of being a family member. We really do appreciate anyone who considers making that planned gift.”

Another reason people choose planned giving is because they can establish a legacy of a family member they care about, Snyder pointed out. “We’re trying to solve problems for vision loss, hearing loss, cancer of the head and neck, and these things really impact people’s lives in a very unfortunate way,” he said. Some people who have made planned gifts have someone in their family or they themselves are dealing with these conditions. They want people to know they cared about it in their lifetime and want it to be honored. “We can do that with a planned gift,” Snyder said. “It can be established as something to honor a family member or have in your name. You can work with a 501(c)(3) ahead of time to establish an endowment or support for research.”

Planned giving also makes it possible for those of us who are not very wealthy to be able to do the kinds of things we would like to do to make an impact in ways that we like to make it, Snyder added.

If someone makes a gift to a Department that no longer exists, Caldwell said it can help to create a contingency plan if it has already been documented with Pitt. They find something that is as “near as possible.” This is another perk of filling out documentation with a charity – the practice is always to ensure that there is backup language, kind of a contingency plan. Language will be built in in case things change in the future. And when this is done through an estate or through a 501(c)(3), a lot of systems are in place.

For annuities, there is a minimum amount of $10K, but no minimum for a planned gift. If you want to do a special fund, like an endowment, professorship, or chair, there are associated levels.

Some people have used vehicles like life insurance to establish something. Caldwell said the most common option with life insurance is changing the beneficiary, whether that is a family, friend, or 501(c)(3) charity. There are other options where you can work more directly with the 501(c)(3) to create a new policy in which they are the owner and beneficiary, so lifetime premiums can be given to the charity. The benefit to you is that you will get the annual deductions for those donations. “Do you need or want those deductions, especially as we’re starting to look at the increased standard deductions?” Caldwell asked. There are some interesting combinations that can be done with life insurance.

Snyder said if you are thinking about something like this at all, reach out to someone – a local charity, university charity, EEF, or whatever organization you would like to work with – to talk about these strategies. There are a lot of different options. “If you want to seek more answers to your questions, keep asking,” he added. “We’re always here to help you find answers.”

Snyder said he highly values EEF’s relationship with Pitt. Obviously, the research EEF supports is there, but EEF would not be able to do some things without having a large institution able to support them.

“Please, do what’s in your heart,” Snyder said. “Do what motivates you. Do what makes you happy. The best gifts are the ones that bring you joy. Planned giving can do that in a special way because you do not have to worry about it today. It will happen in the future, the way you want it to happen. You don’t have to be concerned about it today and will be able to live the life you want with the resources you have.”